The Dollar Sign (Photo credit: Wikipedia)

Last week Scott Douglas published an article on Runnersworld.com with the title “Sales of Minimalist Shoes Plummet.” I’ve seen this article referenced a number of places over the past week, and I wanted to add a few comments.

The data that Douglas referenced come from a SportsOneSource 1st Quarter 2013 summary report. According to the report, “SOS collects point of sale data from most of the major U.S. Sporting Goods, Athletic Footwear and Running and Outdoor specialty retailers.” This is an important point since it shows that the data do not necessarily reflect what actual runners are buying, but rather a broader view of sales out of multiple retail channels (presumably including things like big box sporting goods stores and mall shoe stores in addition to running specialty stores). From a business perspective this makes sense – most running shoes that are purchased are probably not actually used for running, and running shoe companies would not be nearly as profitable if they catered only to hard-core runners. So the SOS data are a good indicator of the broader picture of what people are buying, but not necessarily a good indicator of what runners are actually wearing out on the roads.

Regarding running, here is what the report had to say:

“Running, declared dead by the stock market, continues to accelerate. Sales of Running shoes grew in the high singles for the period. The conventional categories have rebounded nicely.

Stability improved in the mid-teens, Motion Control more than +25% and Cushioning in the mid singles. Lightweight, which remains the largest sub category, grew in the low teens.

One casualty of the return to more conventional (but lighter weight) shoes has been the Minimalist/Barefoot trend. Net of Nike Free, Minimalist/Barefoot declined in the low teens and represented only about 4% of total Running. It appears this fad is pretty much over.

The core Running brands all had strong sales increases. Under Armour Running doubled for the year so far. Brooks and Mizuno improved about 40%, Asics about 25% and Saucony in the low teens.

Nike (60% share) Running grew in the high teens. Adidas and Reebok both declined sharply. Last year to date, Reebok had 10% market share in Running; this year their share was 3%.”

One might look at these data and conclude that minimalism is dead – when Nike Free is removed (because SOS doesn’t consider them to be a shoe used much by runners), minimalist/barefoot sales represented only 4% of sales in the running shoe market. This is indeed a small number, and the trend is that sales have been decreasing of late.

My question is how the minimalist/barefoot category is defined if Nike Free is included, and that gets to my issue when trying to interpret much of the sales data that is out there. I don’t know what is included in these categories, or how they are defined. If the Nike Free Run 5.0 is included in the minimalist/barefoot category, then the definition must be pretty broad and would have to include competitors like the Saucony Mirage/Kinvara, the entire New Balance Minimus range, all of the Brooks PureProject, etc. Judging by which of my reviews get the most traffic (top 5 reviews so far this year in terms of # of hits are of the Brooks PureCadence, Saucony Kinvara, Skechers GoRun 2, Saucony Virrata, and Brooks PureFlow), shoes like the Kinvara/Mirage and Brooks PureProject are among the most popular out there right now among runners. When I was at Saucony HQ a few months ago they told me the Kinvara is one of their top selling shoes. I’d guess that the PureProject is doing quite well for Brooks too. My guess would be that most of those shoes are in the “lightweight” category that is mentioned in the report, which is where I’d see the Nike Free fitting in (Nike Free is amply cushioned and all but the Free 3.0 are above 4mm drop).

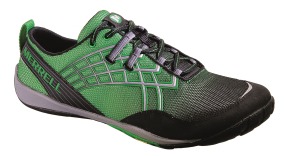

If barefoot/minimalist category consisted of zero drop, minimal cushion shoes like the zero drop NB Minimus, Merrell Barefoot line, and Vibram Fivefingers, then the data make much more sense. Vibram Fivefingers sales seem to have dropped off a cliff, and if my observations at any number of races are any indication, the number of people running regularly in shoes like this has never been very big (even if sales numbers were high). It’s a niche for sure. I view shoes like these as a full time option for some, but as a tool to be used in a mix of footwear for most.

To me, the most important line in the SOS report is the following: “Lightweight, which remains the largest sub category, grew in the low teens.” The lasting impact of the barefoot trend of the past few years will be that it opened up a new category of running shoes that has now eclipsed traditional neutral and stability shoes in total sales (recognizing that defining limits to these categories is a very tricky business since shoes are more on a spectrum now than they are easily divided into neat little categories).

Running shoes have gotten lighter, low drop shoes like the Kinvara and PureProject have done very well, and design elements from barefoot-style shoes have transferred into other categories (e.g., wide toeboxes, zero drop soles in amply cushioned shoes, etc.). The market has shifted toward lighter, simpler shoes, which I think is a very good thing, and variety has increased dramatically, which is even better as it gives each runner more options to choose from when trying to find the perfect match.

When I went to a run specialty store for the first time back in 2007, my options were pretty much limited to a selection of relatively heavy (>10oz) 12mm drop shoes from each manufacturer that fit nicely into either the neutral, stability, or motion control categories. Those days are gone, the market has shifted and science has shown that the old model of fitting shoes wasn’t all that effective. We are now in the midst of trying to figure out how best to fit runners given the variety that now exists.

To give a more honed in view of what runners are buying than what the SOS report reveals, we can take a look at sales data from Leisure Trends Group, which provides reports specifically on sales at run specialty stores (recognizing that even at specialty stores a lot of non-runners are buying the shoes). Let’s take a look at data from February 2013, which is the most recent month for which a complete dollar breakdown by category is provided. Here are sales in dollars by category for running shoes, along with the trend relative to the same month last year:

Stability: 20 million dollars (-7%)

Neutral/Cushion: 18 million dollars (-8%)

Minimalist: 4 million dollars (+2%)

Motion Control: 2 million dollars (-23%)

Race Shoes: 2 million dollars (+7%)

Trail Shoes: 1 million dollars (-25%)

The big losers at run specialty in February were motion control and trail shoes, both of which dropped over 20% relative to Feb 2012. The only categories that increased were minimalist and racing flats. By these numbers minimalist shoes are about 8.5% of sales at run specialty. Still low, but twice the value reported by SOS, and double the sales of motion control. If you add racing flats to minimalist (many minimalist runners purchase racing flats because they tend to have similar design characteristics and are often cheaper), then you have about 13% of the market. Leisure Trends does not appear to break out “lightweight” as a category, and I again don’t know how they define minimalist, so it’s hard to know exactly what is included in these categories. Are the Brooks PureCadence and Saucony Mirage in the “Stability” category? I don’t know.

So what can we conclude from all of this about what runners are putting on their feet? Here’s how I would interpret the data:

1. Barefoot-style shoes like the Vibram Fivefingers and Merrell Barefoot are and will continue to be a very small niche. It’s hard to know from general sales data how much of the recent decline in sales is due to curiosity about toe shoes having died off, and how much is due to the category as a whole dying away. Some will find zero-drop, minimally cushioned shoes to be an answer to their problems, others will try them and have trouble. I value them as casual shoes and training tools, but I prefer shoes with a bit more cushion for most of my running. I think the category will, and should, remain, but will never dominate the market.

2. Lightweight is where it’s at right now. The Nike Frees are killing it in terms of sales, and I would dispute the claim that people aren’t running in them – spend five minutes on any college campus and you will see them on the feet of many of the students running about (I had one student this semester who said she owned like 8 pairs and ran most of her marathon buildup in them). I have several women in my beginner 5K group who are running in them. Yes, they are popular as fashion shoes, but they are decent running shoes as well.

I myself made the jump all the way to barefoot-style shoes, and have migrated back a bit to a sweet-spot that includes light, low-drop shoes with some cushioning. Shoes like the Saucony Kinvara/Mirage and Brooks PureProject are often my first recommendations to runners as they are a good starting point from which people can migrate either upward or downward to find their own sweet spot. My hope is that this category represents the new center of the running shoe spectrum.

3. Motion control shoes are dying away as a shoe choice for runners, but like ultraminimal they have a place for those who have had success in them.

4. Traditional categories are still doing well, and there’s nothing wrong with that. A lot of runners have had long-term success in traditional shoes, and some who have tried more minimal shoes have not found them to be a good fit and have gone back to more traditional models. Top selling shoes are still traditional models like the Brooks Adrenaline, Asics Nimbus, Saucony Guide, etc. I don’t enjoy running in shoes in this mold, but I also don’t see any compelling reason why somebody who has had long-term success in a shoe like this should make a switch.

5. We are blessed by variety. This is the lasting benefit that has come out of the minimalist/barefoot trend. We now have more variety than ever, and the most pressing issue now is how to choose. It remains an exciting time to be a shoe geek!

If you work in running specialty retail, I’d love to hear your thoughts from the trenches – what’s hot right now and where do you see the market going in the future?

Pete I am very surprised at the trail shoe data. At least in my area in CA the trend to trail running is growing. In fact so much so that the local Fleet Feet has stocked several brands of trail shoes and is having weekend trail runs. I have been caught up in this trend running about 30 of my 70 plus miles a week on trails.

My guess is that trail running shoes are more typically bought at outdoor specialty stores (e.g., REI, EMS and the like) and not

run specialty stores. Also on-line. That might be why the number is so low.

—-

Pete Larson’s Web Links:

-My book: Tread Lightly: link to ow.ly

-Blog: https://runblogger.com

-Twitter: link to twitter.com

-Facebook Page: link to facebook.com…

-Discussion Forum: https://runblogger.com/forum

There is also the fact that most of us don’t live anywhere near enough to trails to justify trail-only shoes. I know I don’t.

The one thing I’m curious about is how shoe replacement/purchase rate factors into the broader picture and longer term trends. Given that low cushion minimalist shoes tend to last a very long time relative to the traditional 300 mile recommended replacement interval, one might theorize that many of the minimalist shoes purchased last year and in previous quarters are still in use and that a decline in sales is merely a function of the market dynamics of that niche. Put another way, there are just as many runners in minimalist shoes this year as last, but they simply haven’t purchased as many shoes this year. Minimalist shoes may have a longer purchasing cycle than traditional shoes necessitating a different approach/perspective when evaluating

It’s also possible that the number of runners in the shoes hasn’t changed much, it’s the number of non-runners buying them that has changed.

—-

Pete Larson’s Web Links:

-My book: Tread Lightly: link to ow.ly

-Blog: https://runblogger.com

-Twitter: link to twitter.com

-Facebook Page: link to facebook.com…

-Discussion Forum: https://runblogger.com/forum

Interesting thought. It would stand to reason then that the increased availability of “non-running” minimalist shoes marketed towards x-fit and other activities might have contributed to the decreased running sales as well?

Good question. For me the big question is what constitutes minimalist/barefoot in terms of the business view of the shoe category? I’m not sure what the answer is or who categorizes the shoes. I think runners have a sense that minimalist is something less than traditional shoes in weight, drop, etc. But a barefoot shoe is something flat and with minimal cushion like the Vibrams.

—-

Pete Larson’s Web Links:

-My book: Tread Lightly: link to ow.ly

-Blog: https://runblogger.com

-Twitter: link to twitter.com

-Facebook Page: link to facebook.com…

-Discussion Forum: https://runblogger.com/forum

One point to consider with the minimalist market is that runners may not need to replace their shoes as often. I purchased a pair of vivobarefoot neo’s in Jan of 2012. Sine there is nothing to “crush out” I am still running in them. Just ran a half marathon in them this morning. Could be that there is less built in obsolescence with these products as well.

I was going to make this exact point. The 5-fingers shoes last a long, long time. My huaraches last forever. http://www.invisibleshoe.com ‘s owner, Steven Sashen, guarantees them for 5,000 miles.

Personally, I’ve found the opposite to be true. I typically discard my shoes due to blown out uppers. The more minimalistic shoes tend to use lighter materials and less reinforcement in the uppers, even though they are usually targeted for general use, where a couple ounces extra for durability would be an asset for shoe life, rather than racing, where being really light actually makes a difference. My recent more traditional shoes are being retired at 1,500 to 1,750 miles. My more minimalistic shoes are lucky to last 300 to 500 miles.

My Saucony Kinvara 3’s lasted me a good year and at least 1,500 miles before I felt compelled to replace them. Nothing was falling apart, but they looked worn and I like new shoes.

In the first quarter of 2013, my household bought two pairs of Kinvara 4’s, one pair of Virrata’s, and one pair of Saucony A5 flats. All from Running Warehouse of course.

If I had to guess, those would all go in the lightweight category, not the minimal/barefoot, but I could be wrong. Lightweight is the biggest category out there right now in terms of sales.

—-

Pete Larson’s Web Links:

-My book: Tread Lightly: link to ow.ly

-Blog: https://runblogger.com

-Twitter: link to twitter.com

-Facebook Page: link to facebook.com…

-Discussion Forum: https://runblogger.com/forum

Working in the industry of selling shoes gives me a different perspective than some. If what is being referred to as minimalist shoes is the barefoot style, then yes, that segment is down. We are seeing very few people buy them again after their first purchase. Return customers are buying the lightweight models instead. People want more protection than the barefoot models provide. Lots of people bought into the hype about minimalism changing their footstrike and gait pattern to a more natural movement. The problem is that we live in a society of instant gratification and most people didn’t want to take to time required to transition from traditional shoes to barefoot models. People were either transitioning too fast and having a variety of issues with lower leg and foot problems, or they were still heel striking/over striding and having lots of pain because there is no cushioning. The lightweight shoe category continues to have strong sales. The zero drop shoes with cushioning are doing well. However, as the data suggests, traditional shoes are still making up the largest segment of sales. Stability and neutral/cushioning shoes remain the choice of most runners. People who need motion control shoes are a very small percentage, and that is one of the reasons that segment is so small.

Other reasons for declining sales of barefoot style is many people wear their shoes for more than just running. They were finding it wasn’t comfortable to be on their feet all day wearing a barefoot shoe. Additionally the price of the shoes was a factor. Many of the barefoot models aren’t made of materials significantly different from water shoes that can be bought for $10-15. Paying $100+ for barefoot shoes that have no tech features is a big negative. Customers weren’t seeing the value of paying that much for basically a piece of rubber attached to an upper. These shoes should not have been priced in the same range as traditional models.

I agree about the cost – even if durable minimal shoes are harder to make, people perceive a flimsy shoe for the same price or more as a more traditionally made shoe to be a ripoff. What we need are minimal shoes at minimal prices that look better and last longer than water shoes.

—-

Pete Larson’s Web Links:

-My book: Tread Lightly: link to ow.ly

-Blog: https://runblogger.com

-Twitter: link to twitter.com

-Facebook Page: link to facebook.com…

-Discussion Forum: https://runblogger.com/forum

I started with Kinvara 2 and was fine with the first 2 pairs, however on the third pair my, it caused issues with IT band. Went back to NB 890V2, this time and IT band issue went away with no issues. Have been running in ever since. Still lightwight but more stable for me for a runner who supinates, whereas the Kinvara will blow on sides

Before all the minimal and light shoes came out I generally only had a couple of pairs of running shoes. After the running shoe companies started making some shoes worth buying I now have so may shoes that I can’t find enough miles to wear them out. That may be why the drop in minimal shoes. After we get enough shoes that don’t wear out we don’t have space for more shoes. I still like cushioned shoes and minimal shoes but will never again buy a stiff, heavy, high heeled running shoe like most of those sold 10 to 15 years ago. I wish I could find some steel toed work shoes that are flat, have room in the toe box and don’t weigh so much. That is another direction the shoe companies should look at. Heavy high heeled shoes kill my knees.